Table of Contents

What is Mr. Market?

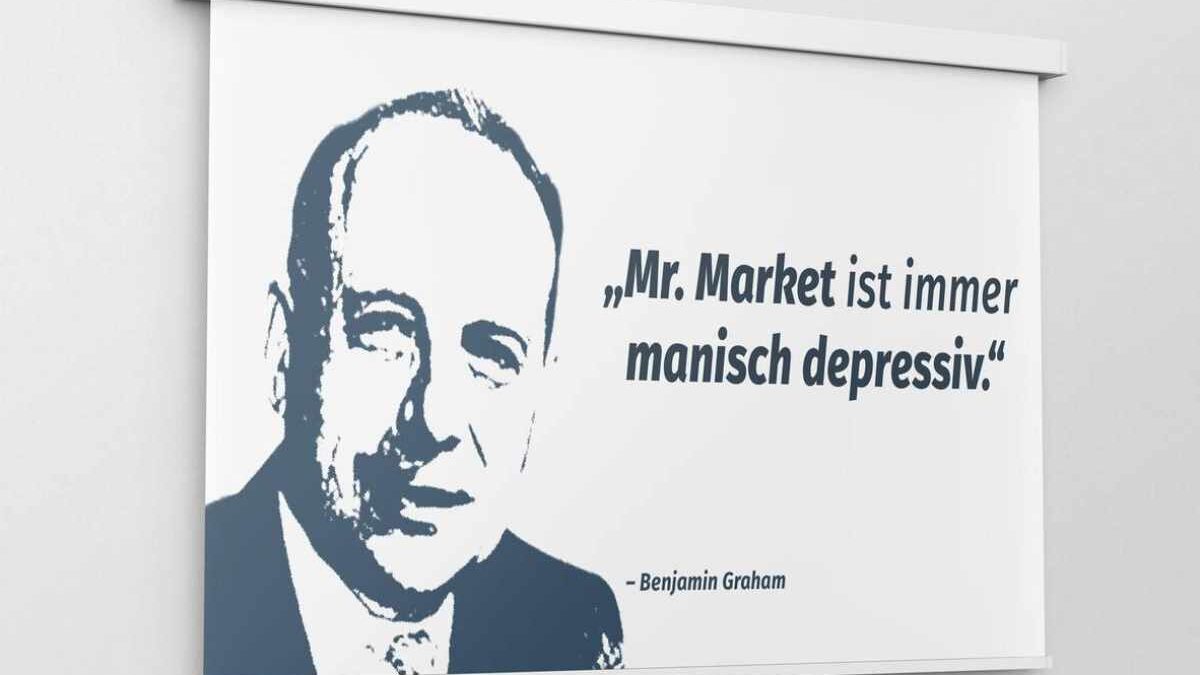

In his 1949 book The Intelligent Investor, Benjamin Graham created the fictional investor Mr. Market as a metaphor. In the novel, a fictional investor named Mr. Market is motivated by fear, exhilaration, and indifference on any given day and invests according to his mood rather than using fundamental (or technical) research.

According to contemporary interpretations, It is a manic-depressive individual who flits unpredictably between episodes of optimism and pessimism.

Conclusions General

- Benjamin Graham created the fictional investor Mr. Market and first used him as a metaphor in his 1949 book The Intelligent Investor.

- Market is an investor prone to erratic fluctuations of pessimism and optimism, and since the stock market is made up of these types of investors, the market as a whole takes on these characteristics.

- According to Graham, a prudent investor can buy stocks at a bargain price when Mr. Mercado is too bearish, and when It is too bullish, investors may choose to look for an exit.

- Market is constantly creating ups and downs in stock prices, and prudent fundamental investors are not put off by this as they look at the long-term big picture.

History Mr. Market

Investor and writer Benjamin Graham invented the book Mr. Market as a clever way to illustrate the need for investors to make rational decisions about their investment activities, rather than letting emotions play a role. It teaches that although prices fluctuate, it is important to look at the big picture (fundamental factors) and not react to temporary emotional reactions. Graham is also known for his most successful student, billionaire investor Warren Buffett.

Greed and fear remain now recognized features of advanced capital market systems. The herd behavior of these markets and of the people who inhabit them can sometimes gravitate towards certain stereotypes. It is one of those archetypes.

Legendary investor Warren Buffett, an avid student of Benjamin Graham, often studies The Intelligent Investor, especially Chapter 8, where Graham describes Mr. Market. Buffett even called this book the best book on investing ever written.

Lessons from Mr. Market

Mr. Market is ready to constantly buy or sell shares, depending on whether they have been rising or falling lately. However, these actions are based on emotions from recent events and not sound investment principles.

Graham and his followers believe that investors are better off assessing a stock’s value through fundamental analysis and then deciding whether a company’s future prospects justify buying or selling the stock.

Because It is so emotional, he will give diligent investors the opportunity to get in and out at auspicious times. When It becomes too bearish, valuations of good stocks will be favourable, allowing investors to buy them at a reasonable price relative to their future potential. When It is overly bullish, this may be a good time to sell stocks at an unwarranted valuation.

How Did You Find Out About Mr. Market?

His hypersensitive nature has remain cited many times to explain the wild fluctuations in the stock markets. Warren Buffett called The Intelligent Investor “by far the best book on investing ever written” and it became very famous.

What You Need To Know About Mr. Market?

Mr. Market’s assessment of the value of his business often fluctuates from very optimistic to very pessimistic, and the book makes it clear that the only reason for this change is Mr. Market’s emotions. A rational person will sell when the price is high and buy when it is low; he would not sell a stock simply because the price has dropped.

Graham finds it important to focus on whether a company’s stock valuation is reasonable after assessing its value through fundamental analysis. This contrasts with Mr. Mercado, who is impatient and impetuous.

Who is he?

Mr. Market is a hypothetical investor who exhibits irrational yet predictable behavior based on sentiments such as fear and greed.

Who Invented it?

The Mr. Market allegory remain coined by legendary value investor Benjamin Graham in his book The Intelligent Investor, published in 1949.

Is Mr. Market Relevant Today?

Yes, individual investors are still subject to episodes of irrationality and emotion. Behavioral finance has been around since Benjamin Graham to understand the cognitive and psychological underpinnings of this irrational behavior and bias.